"At last, someone who understands my business!" Business Coaching, New Zealand

NZ Business Coaching How business coaching works

NZ Business Coach - The Blog Coaching for New Zealand Businesses

Seize the Opportunity

“You only get one crack at a big opportunity so make sure you recognize it and grab it with both hands.” – Gary Richards.

The NZ Entrepreneur

A NZ entrepreneur is a dreamer, someone with a vision, but someone who must put that vision into action. Plan for a thriving business.

Know Your Big Why

Know your “Big Why”. Many entrepreneurs usually have an area of expertise, but they haven’t studied small business success.

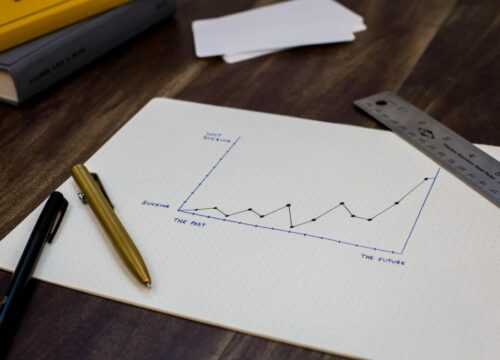

Scalability: Find a NZ Business That Can be Scaled Up

If your business provides a product or service that other people can be trained to buy, then you have scalability.

Maximise Your Thud (Perceived Value) Factor

Understanding your business’s perceived value can lead to better pricing strategies and stronger customer loyalty.

How to Build a Successful Business Without Burning Out

If you’re wondering how to build a successful business, focus on consistency, systems, and support – not just sales and hard work.

Be Passionate About What You Are Doing

If all you think about is money, your business is never going to work. You have to be passionate – and you have to want to win.

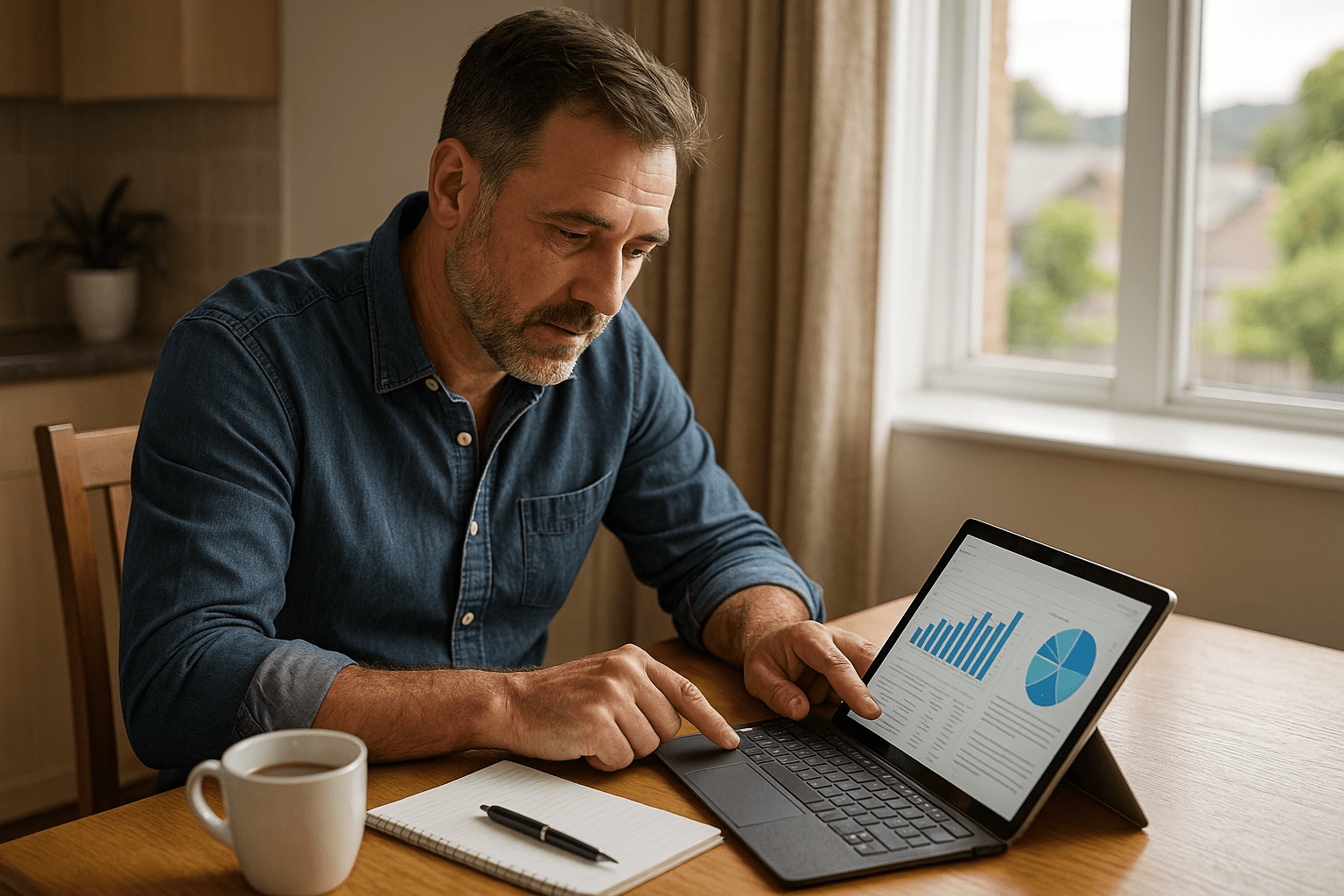

Have a Solid Business Plan

You need traditional elements of a business plan like company’s products and services, strategy, market analysis, financial projections.

Your NZ Business Questions Answered...

What is the best passive income in New Zealand?

Wondering what the best passive income in New Zealand really is? Here’s a practical look at options that work for business owners and investors alike.

Who can be self-employed in New Zealand?

Who can be self-employed in NZ? Eligibility criteria for self-employment in New Zealand explained. Resources and support.

What is the hardest thing to start a business?

Starting a business can be daunting, but with the right strategies, you can overcome challenges like funding, attracting customers, and maintaining work-life balance. Learn how in this article.

What is the benefits of being a sole trader?

Discover the advantages of being a sole trader and how to maximize success in business. Gain control, retain profits, simplify taxes, and foster customer relationships.

What is the tax on a small business in New Zealand?

Tax on a small business in New Zealand depends on your structure, income, & GST status. Here’s a plain-English breakdown of what you might owe

What is the failure rate of small business in NZ?

Unveiling the reality of small business failures in New Zealand, exploring factors contributing to the grim statistics and strategies for success in entrepreneurship.

Hobby or Business? How to Tell the Difference in New Zealand

Wondering if your activity is a hobby or business? The difference affects tax, reporting & your long-term plans. Here’s what you need to know.

What type of accounting is best for small business?

Discover the advantages of accrual accounting for small businesses, from improved financial visibility to compliance with accounting standards.

What is the most profitable business in New Zealand?

What are the most profitable business types in New Zealand for potential investment opportunities, or business diversification?

Types of Income Not Taxed in New Zealand

Some income is not taxed in New Zealand, but most people are surprised by what’s still included. Here’s a quick breakdown in plain English.

What’s the difference between self-employed and entrepreneur?

Discover the nuances between self-employment and entrepreneurship: from offering services as a sole proprietor to scaling a venture for long-term success.

What is the lowest income tax rate in NZ?

Explore New Zealand’s progressive income tax system, where higher earners face higher tax rates. Learn how this system promotes fairness and social welfare.